What Is General Liability Insurance?

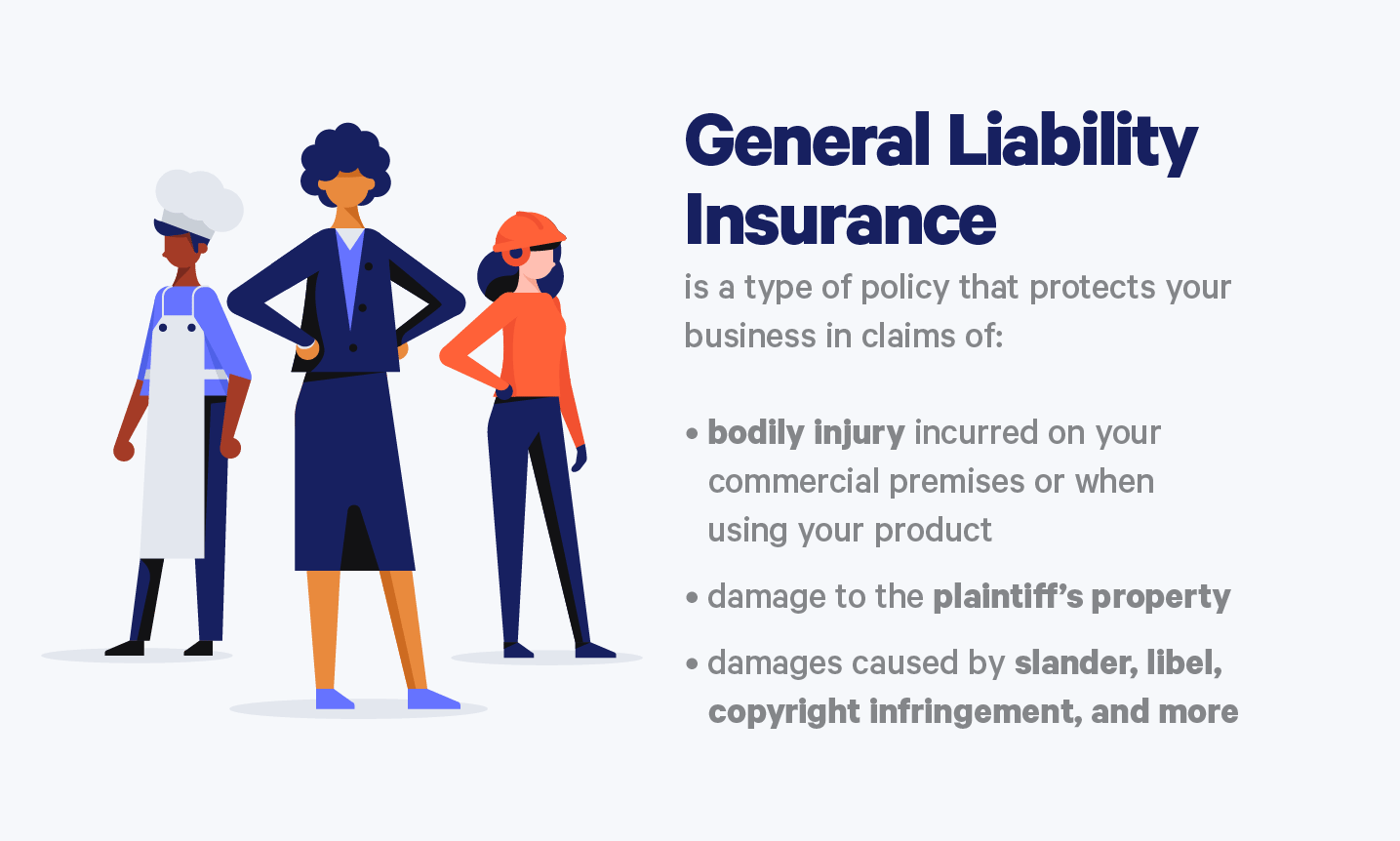

General liability insurance is a form of coverage that is designed to protect businesses from a range of risks associated with operating a business. This includes coverage for property damage, personal injury, and advertising injuries.

Coverage for bodily injury

Bodily injury liability insurance is a type of insurance that pays for damages that result from an accident. It can also help you defray legal costs if you are sued.

Most states require drivers to have at least a minimum amount of bodily injury liability insurance. Some of these states allow consumers to buy coverage higher than the minimum requirements.

Bodily injury insurance is the part of a general liability policy that covers medical expenses, lost income and legal fees. It is available in two types. One is a combined single limit policy, and the other is a split limit policy.

Bodily injury insurance pays for your injuries, as well as the injuries of others. In some cases, it will also cover funeral expenses. If you are suing the person who caused your accident, it can help you pay for legal fees.

Property damage

If you own a small business, you need to protect it from liabilities. You may not be able to afford a big payout in the event of a claim, but getting a good coverage policy will go a long way towards protecting you.

General liability insurance is one type of policy you may want to consider. It is designed to protect your business from many common risks, including lawsuits, damages, or bodily injuries.

You will need to make sure your insurance has the right features for your particular business. One feature that is particularly important is property damage liability coverage. This is an insurance policy that pays for the repair or replacement of a customer’s damaged property. Whether the damage occurred at your facility or on your property, this policy will be there for you.

Personal injury

General liability insurance is a very important policy for your business. It protects you from lawsuits, as well as damages if you are held liable for someone’s injuries. The policy also pays for medical costs and other legal fees.

Although general liability insurance covers both bodily injury and personal injury, it is important to note that there are differences in the types of injuries that are covered. For example, it may not cover an accident that happens on your own property.

Alternatively, it may cover a customer’s physical injury that occurs on your premises. This could be the case if your customers slip on wet floors while mopping. Another possible scenario is a customer who tries to sprain their ankle while working with tools.

When it comes to personal injury, it is often a difficult choice between a business’s responsibility for an injury and the cost of defending the lawsuit. But knowing the difference between the two can help you determine which coverage is most valuable to your company.

Advertising injury

Advertising injury and general liability insurance is a form of coverage that protects business owners against claims of libel, invasion of privacy, and copyright infringement. The coverage also covers legal fees and damages.

Advertising injury and general liability insurance coverage is included in a standard Commercial General Liability (CGL) policy. It is not included in an umbrella policy.

Advertising Injury and General Liability Insurance is an important part of a business’s general liability policy. Insureon can help small business owners compare quotes from multiple insurers.

There are many different types of advertising injuries. Some of these include competitor slander, disparagement of goods or services, wrongful eviction, and copyright infringement. Usually, the injured party suffers financial loss and sues the business for compensatory damages.

In some cases, the advertising injury may be directed towards an individual. For instance, a law firm or accountant might be sued for slander if a client reports an error in their accounting.

Run-off coverage

Run-off coverage is one of the many forms of professional indemnity insurance. It is designed to protect professionals who give professional advice or provide services. These professionals may include architects, solicitors, accountants and engineers.

The benefit of run-off cover is that it will protect you from claims made within a period of time after you cease trading. This is particularly important for professionals who were not able to find cover at the time they stopped trading.

One of the most important aspects to consider when purchasing run-off coverage is the length of the coverage. While the minimum period is generally six years, a number of insurers will offer policies for longer periods.

For example, an architect might let his professional indemnity policy lapse after a large commercial project is completed. In the event of a claim, the architect would be in no position to defend himself because of the loss of cover.